The Elis SA buying spree is always exciting to analyze. In the last few days, I have updated my Excel file again with the latest numbers, and there are some compelling findings.

Highlights of the Elis Group's M&A activity:

- Average purchase price: 1.6 x sales, 6.1 x EBITDA, 14.6 x operating profit and 28 x net profit.

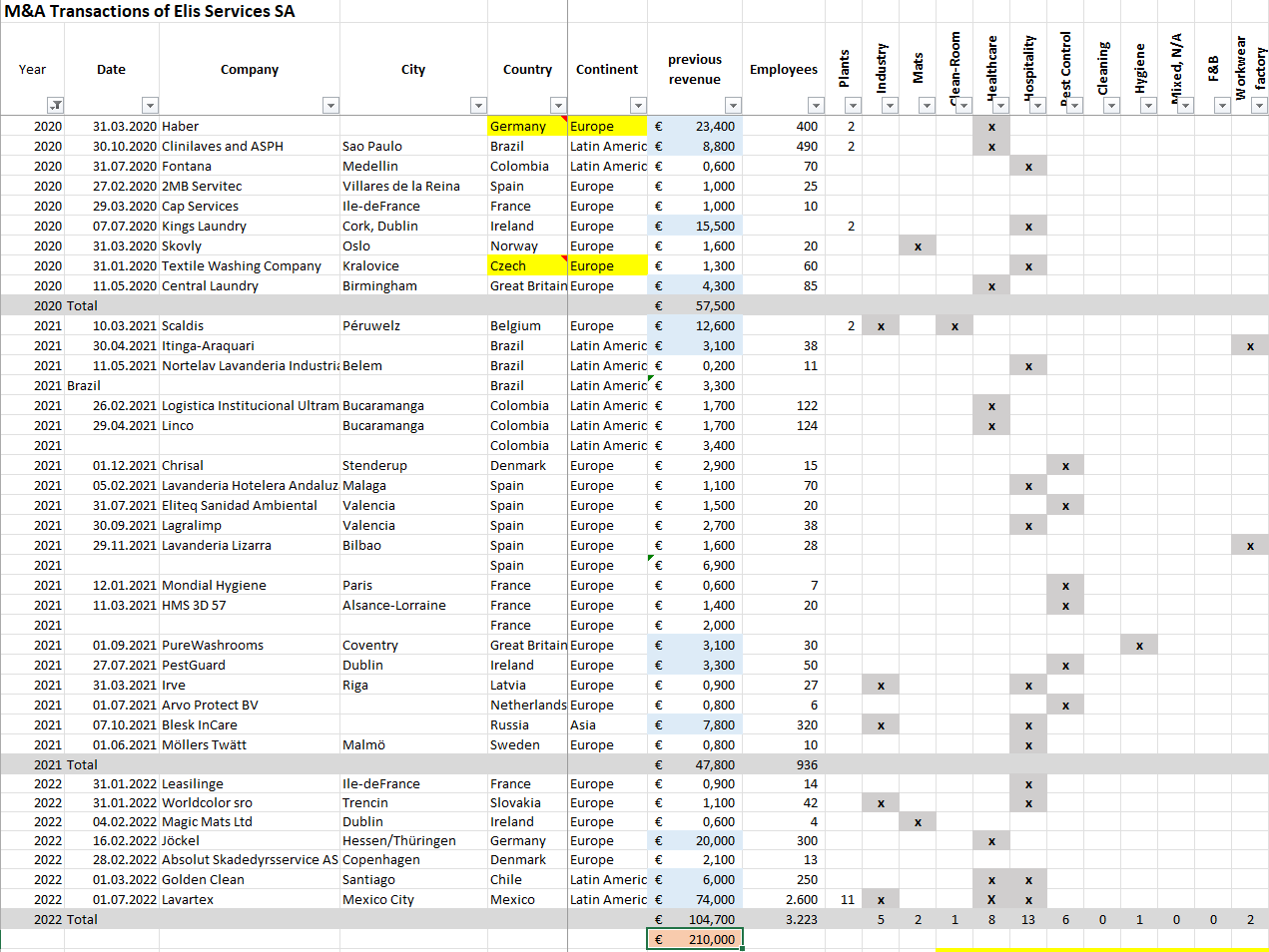

- Elis SA has bought almost unabated even during the pandemic: 33 transactions with € 210 million in sales since 2020.

- Market entry in Mexico with the acquisition of the market leader generating sales of € 74 million

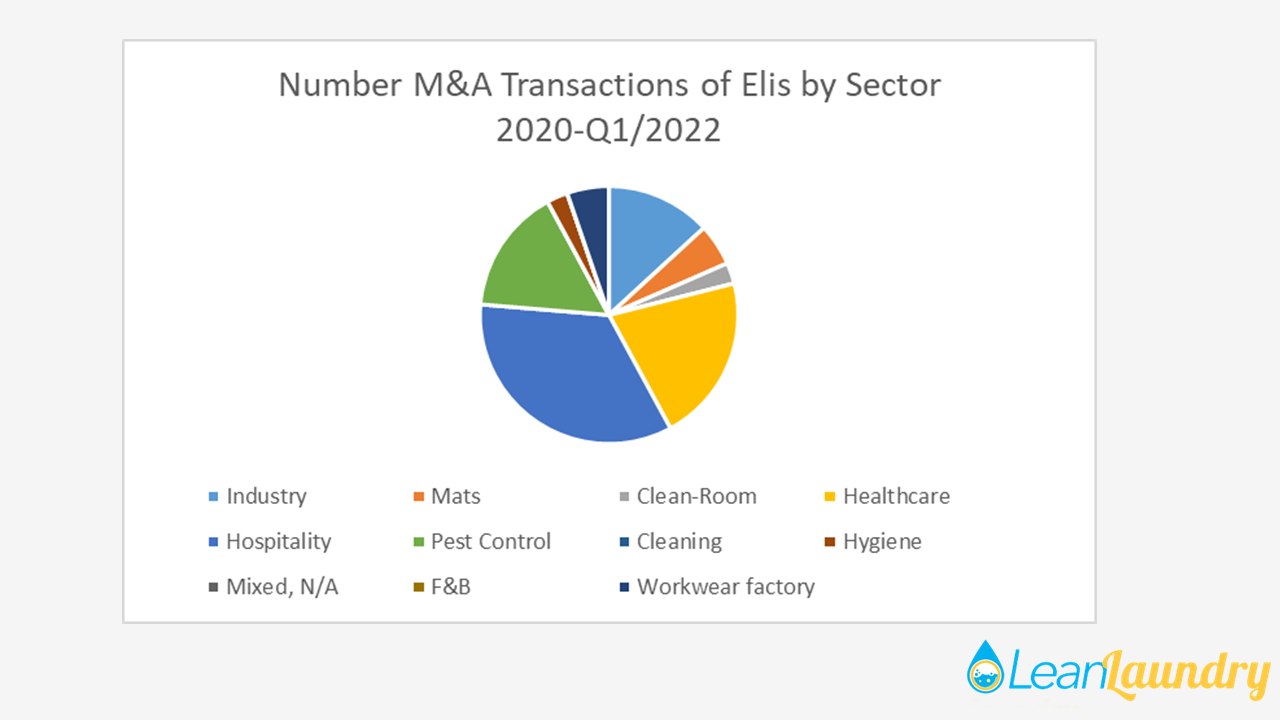

- Virtually no focus within the laundry industry (industrial & commercial, healthcare, hospitality, matting, cleanroom, pest control).

- 25 small transactions with less than €3 million in sales since 2020.

- M&A dominates Elis SA's business model: € 3.5 billion in purchase price over ten years for 139 transactions compares to € 3.3 billion in total debt, and virtually all additional revenue growth corresponds to acquisitions.

Further, I would like to share fascinating insights in this article and critically question the meaningfulness of this M&A activity.

Disclaimer, Background, and Motivation

This article shall help entrepreneurs and executives in the textile service sector better understand what is happening in the industry and create a basis for discussion.

I try to analyze the figures, data, and facts objectively. Since I have been active in the industry for more than 30 years as an executive, entrepreneur, and now management consultant and have been involved in M&A transactions and have conducted one myself, I have experience on the one hand and also my own opinion.

My personal experience in M&A:

- 1998: Part of the team in selling FDR Services (New York) to TARTAN Textile Services. FDR had $20 million in sales and about 1,000 employees. As assistant to the CFO, my task was to prepare the figures for the transaction and assist in drafting and negotiating the purchase agreement.

- 2008: Purchase of Umlauft Texilservice with € 12 million turnover and two plants, including the post-merger integration process management. Overall, the transaction was very successful, and the turnover of Umlauft had increased to € 18 million within ten years.

Furthermore, I have been analyzing corporate acquisitions in the industry very intensively for more than 30 years now. I know many of the acquired companies and have observed the long-term performance of these transactions - whereby my observations primarily relate to Europe and here in particular to Germany and Austria.

As for the basics, I had the privilege to take an excellent course in corporate finance at the University of Toronto. I graduated with an A+ as one of the top 2 in the class. So I am very familiar with the analysis of annual reports.

However, my analysis and opinions in this article are also very subjective, and everyone should form their own opinion.

There is also no guarantee for the processing of the figures. Therefore, this article is not written for investors and is no buy/sell recommendation for Elis Group shares or bonds. I am neither "long" nor "short" invested in Elis SA and have no other financial interests.

Furthermore, I appreciate the strengths and the abilities of Elis and the management of Elis. But I do not hold back with critical views because this is important for a discussion and learning from experience.

Therefore, this article should not be understood as "Elis-bashing", but I also want to bring topics to the point. Thus, the content also has rough edges ... and that I am critical of the Elis M&A process is no secret. After all, you can consider this blog post as an opinion piece.

Sources and Excel file

All Elis data originates from the annual reports. You can find all the information on the Elis website: LINK

You are welcome to access the Excel file with all transactions in the Leanlaundry member area. There is also a ZIP file with the extracts from the annual reports here (saves a lot of work). This is a service for subscribers to the Newsletter.

As mentioned above, I cannot rule out errors in the analysis and am happy to receive comments.

Low success due to M&A - The Reason for Mediocre Stock Performance?

Elis SA Service Group - Is the M&A Prozess the Cause of Underperformance?

This chart compares Elis with the index of companies in Europe of comparable size. Elis is also a component of the index. The index is up 15%, and Elis is down 23%.

In 2017 and 2018, investors were very enthusiastic about Elis' consolidation power in the laundry industry. Even before the pandemic, disillusionment set in.

Therefore, the question is: is the inability to finance the M&A out of free cash flow a primary reason for the share price development in recent years?

How Capable is Elis SA to Consolidate the Industry with M&A?

The Reality: Berendsen in Europe was the Only Consolidation Success ...

If you exclude Berendsen as a particular case, Elis SA buys on average € 50 million of revenue in Europe per year (€ 500,000,000 in 10 years). Including Berendsen, it is an average of € 180 million in sales per year.

The European market in textile services is estimated at around € 12 billion, giving Elis SA a 25% market share.

A conservative assumption is that the market grows by 2-3% each year (general GDP growth plus outsourcing). Therefore, the market growth is € 250-400 million p.a. Elis SA needs to grow € 50-100 million every year to maintain the current market share.

Since Elis Services Group's de facto organic growth has been meager over the last ten years, Elis SA's current M&A of around € 50 million only stabilizes its current market share, and only additional M&A (like Berendsen) leads to actual consolidation. (alternatively, Elis could also start to grow organically).

The average purchase price Elis SA paid was 1.6 times sales. The regular M&A budget that Elis SA can finance from its cash flow is € 80-100 million or € 50-60 million additional sales. - i.e., any additional consolidation is not feasible without additional debt or a share issue.

Outlook: How will the M&A proceed?

Elis SA is, therefore, one of the leading players in the consolidation of the European market. Still, the actual consolidation power of Elis SA is essentially dependent on additional equity and debt.

As of March 2022, the expansion continues unabated, and with Mexico, a new country is also being developed. According to the CEO, the medium-term M&A budget is € 100 million per year and will be significantly exceeded in 2022.

Personal Assessment:

Given the moderate performance of Elis SA's share price over the last five years and the current macroeconomic situation, it is questionable whether this can and will continue at the same pace. I expect significant challenges in refinancing starting in the following months or 1-3 years. In this case, Elis SA will have to slow down its activity.

As of March 2022:

- Elis' Bond is now already yielding 3.08%, and if we actually slip into a recession (which is currently very likely), refinancing costs can quickly raise to 5%, 7%, or even 10%.

- Every percent higher interest rate is € 30-35 million more financing costs for Elis. In my estimation, 3-4% higher interest rates will massively slow down the M&A process.

- Elis SA needs to refinance over € 1,000 million in 2022. (2 bonds will mature in 2023, and the purchase price for Mexico). It will be interesting to see what terms Elis will get.

- Elis is not "investment grade" with a rating of "BB+" from Standard & Poors, i.e., one of the better "High Yield Bonds." This market is currently severely impacted by the Ukraine crisis. This situation does not have to persist but may also worsen in the event of a recession. Thus, the future of Elis' M&A is by "Putin's and ECB's grace."

But - as with Berendsen - Elis is always good for a surprise. And things might turn out better.

What companies does Elis Service Group buy?

The answer to the question is simple: virtually any laundry that makes a good profit and small companies for pest control in France and more and more countries.

In der Auflistung der Firmen sind praktisch keine richtigen Sanierungsfälle dabei und das durchschnittliche (etwas geschönte) Betriebsergebnis "Operating Margin" beträgt 12%. Elis SA hat offensichtlich kein Interesse die eigene Marge zu reduzieren, indem man günstig Unternehmen mit schlechten Margen kauft. Lieber wird gutes Geld für gute Unternehmen bezahlt.

Elis SA Service Group M&A Activity During the Pandemic

Elis SA Service Group M&A by Sector

There are practically no real restructuring cases in the list of companies, and the average (somewhat embellished) operating margin is 12%. Elis SA is not interested in reducing its margin by buying cheap companies with poor margins. It prefers to pay good money for good companies.

Even in the pandemic period, Elis SA also bought hotel laundries. One might have thought that the pandemic would have led to a focus on industry, commerce, and healthcare - this is not evident.

50% of the transactions are laundries and pest control companies with less than € 3 million in revenue, and the rest are - with few exceptions - up to € 40 million in revenue.

The strategy is first to buy the market leader in one country and then constantly expand the market share with many small and medium-sized transactions ("Bolt-on Acquisitions"). This process has no end because smaller companies are still being bought even in markets dominated by Elis (e.g., France).

Subscribers of my Newsletter get access to the Excel file on request.

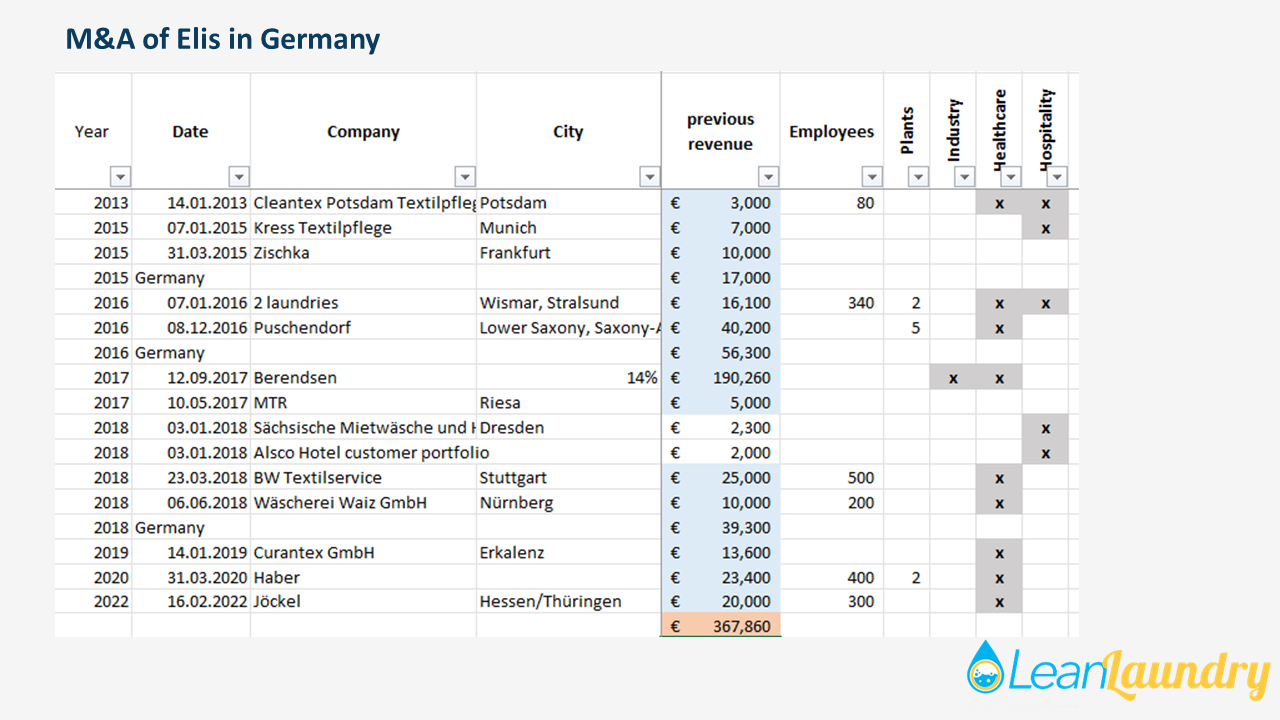

Elis Service Group in Germany

Elis SA Service Group M&A in Germany

In Germany, Elis SA is primarily a significant player in the healthcare sector and, according to its figures, generates sales of € 391 million. Thus, Elis SA has an estimated 12% market share in Germany - and is not #1, but "only" one of the major players on the market.

The € 391 sales correspond to around € 350 m sales of the acquired companies, i.e., Elis SA is likely to have achieved about 11% organic sales growth, including price adjustments in the average three years. Thus, organic growth is in the green zone at an estimated 3% per year.

Elis SA paid around € 480 million for these € 350 sales. (The Berendsen is split according to sales).

Except for Berendsen, the purchase price was 70%-90% of sales (Another exception was Kress and Zischka with an average of 1.4 times sales). Unfortunately, no EBITDA or EBIT factors are published.

Therefore, the purchase price is significantly lower than e.g. in South America, Switzerland, and Russia ... This may be due to the intense competition and thus lower profitability in Germany.

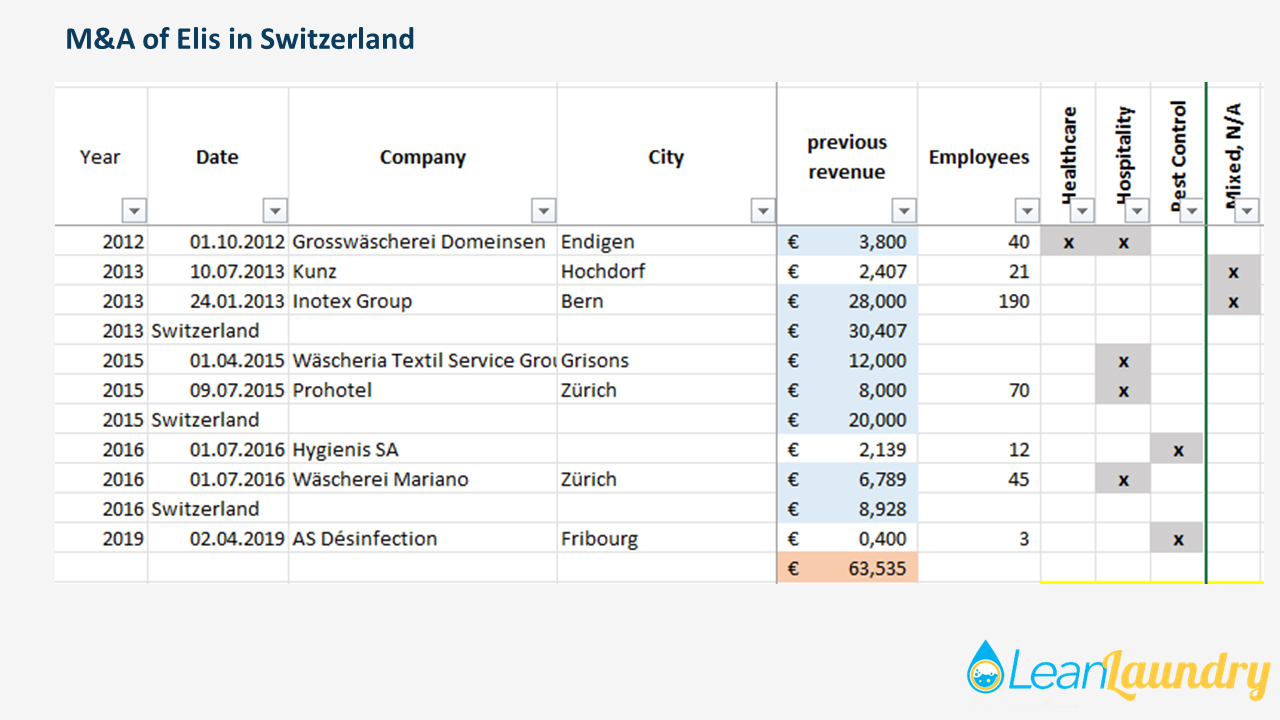

Elis Service Group in Switzerland

In contrast to Germany, I have little insight into the transactions in Switzerland.

Here is the list of all M&A activities in Switzerland:

Elis SA Service Group M&A in Switzerland

Purchase of Berendsen

In 2016, the Berendsen board made the mistake of overreacting to the investment backlog in England by announcing an enormous investment program. In doing so, it massively unsettled investors, and the stock price plummeted.

Elis SA seized the opportunity and made a hostile offer. The purchase was then completed in 2017. The rest is history and very well documented on the Elis SA website.

Berendsen was a perfect regional complement to Elis SA. There was probably little change in the customers and employees because on the one hand they were already used to a group before and there was also little need to make extreme changes here.

But whether Elis SA brings real added value to the ex-Berendsen operations is worth a separate analysis. It is at least not obvious since Berendsen also had very professional management.

How much is Elis SA Paying for These Purchases? Are They Overpriced?

We can assume that the purchase price is determined with the Discounted Free Cash Flow Method or EBITDA and EBIT factors.

The purchase price of individual companies is transparent only if only one company was purchased in a country in a given year. The EBITDA, the operating margin, and the annual profit are only reported in total for each year.

The average of all 139 transactions is as follows:

- Sales-Multiple: 1.6

- EBITDA-Multiple: 6,1

- Operating Margin-Multiple = 14

- Net-Income-Multiple = 28

Overall, therefore, the purchase prices can be regarded as high. These high valuations also result in high goodwill in the balance sheet of Elis SA.

The purchase prices in Latin America appear to be highly inflated. The reason may be that the favorable refinancing costs in the eurozone tempt high offers.

Personal assessment (March 2022):

- The cost of capital is increasingly rising, and, at the same time, growth expectations are declining.

- Accordingly, current valuations in the sector will soon no longer be sustainable and will decline.

- It also cannot be ruled out that the market for laundry companies will be a classic buyer's market. This was already the case around 2005-2010 when the market had completely turned around. Around 2000 a seller could choose from many buyers (Berendsen, Haniel, Initial were all aggressive.) After 2008 there was a complete lull, and even before that, the market was much quieter.

Elis Group Grows Only Through M&A

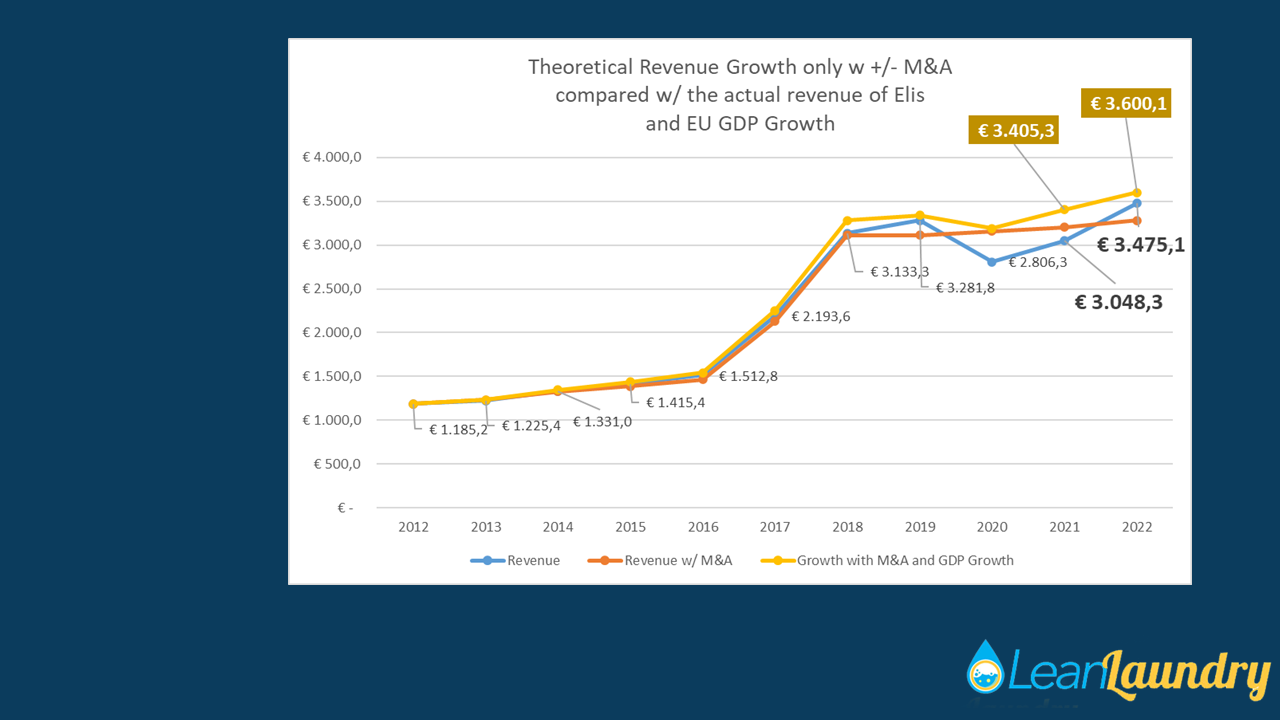

Elis SA Service Group Revenue compared with the Impact of M&A Activity

A highly simplified calculation:

- € 1.1 billion sales of Elis SA in 2012

- + € 2.1 billion sales of all acquired companies by 2021

- = € 3.2 billion sales excluding organic growth, currency fluctuations, price increases, etc.

- Actual sales in 2021: € 3.05 billion

i.e., Elis SA's sales are currently € 150 million lower than the sum of the original sales plus all acquisitions.

*** IF THERE IS A MISTAKE IN MY CALCULATON, I AM HAPPY TO REDACT IT *** (I have checked it several times)

If one would assume a growth like the GDP in Europe (yellow line), then the actual sales of Elis SA is EVERY year below the purchased sales.

This allows us to make the following somewhat abbreviated statements:

- In total, Elis SA seems to grow only through M&A activity or

- due to customer losses, low pricing and/or currency fluctuations, the entire organic growth is again leveled out.

In detail, the moderate growth may have the following reasons:

- Calculation error on my part. I am ready to correct it immediately. Everyone is welcome to view the original Excel file.

- Poor development of the overall market. A general stagnation or decline of the market can be ruled out for the pre-pandemic period; the textile service market is growing 2-3% above GDP as there is still a trend towards outsourcing.

Of course, the pandemic hit textile services particularly hard, especially in the hospitality sector, and the overall market has slumped more than GDP has declined.

Good companies in the sector manage long-term growth averaging 5-8% per year above inflation. - Approximately € 90 million sales were bought in 10 years with small transactions and reported as "organic." Small transactions under €3m internationally and €5m in France are considered organic sales by Elis' definition. However, in my table, it is listed as M&A (just as Elis reports it under M&A).

- Currency fluctuations. Probably between € 100-150 million reduced sales overall due to the appreciation of the Euro, especially against currencies in Latin America. Exchange rate fluctuations are neither good nor bad … as long as you have not paid too much at the purchase price.

- Customer losses after company acquisitions.

That this happens is a fact. However, it is difficult to quantify the magnitude; most losses occur within 2-5 years. - General churn-rate. Elis reports issues with churn-rate in England (which have been improved). Unfortunately, there has been no group-wide data over many years.

- Price development. It is difficult to understand how the price level of the service develops, as - to my knowledge - no total volumes (e.g. kg) are reported. Due to the stable margins, it can be assumed that the price level is sound overall.

- According to my observation, a lack of sales success can be ruled out. New contracts are being signed, and one can assume that the sales success of Elis is at least average - probably above average. But unfortunately, the numbers are missing here as well.

- Substitution on a larger scale can also be ruled out. There is always a back and forth as to whether a customer purchases individual items made of textile or paper or whether one completely dispenses with tablecloths, for example. On the whole, the market is (currently) very stable. Furthermore, Elis also supplies merchandise.

- Impact of the pandemic. The decline and recovery of volume in the hotel segment is reported as organic growth and does not make the analysis of the real market success any easier.

- Impact of inflation. Inflation was extremely low in Europe until recently, but inflation in South America was significant. Rising prices are also reported as organic growth - so, especially the growth rates in South America and now in 2022, in general, need to be corrected.

- Any other reasons I missed - please comment.

"It is as it is," a wise person once said. What precisely the reasons are is challenging to comprehend as an outsider.

Surprising: Elis SA Does not Manage to Generate Added Value.

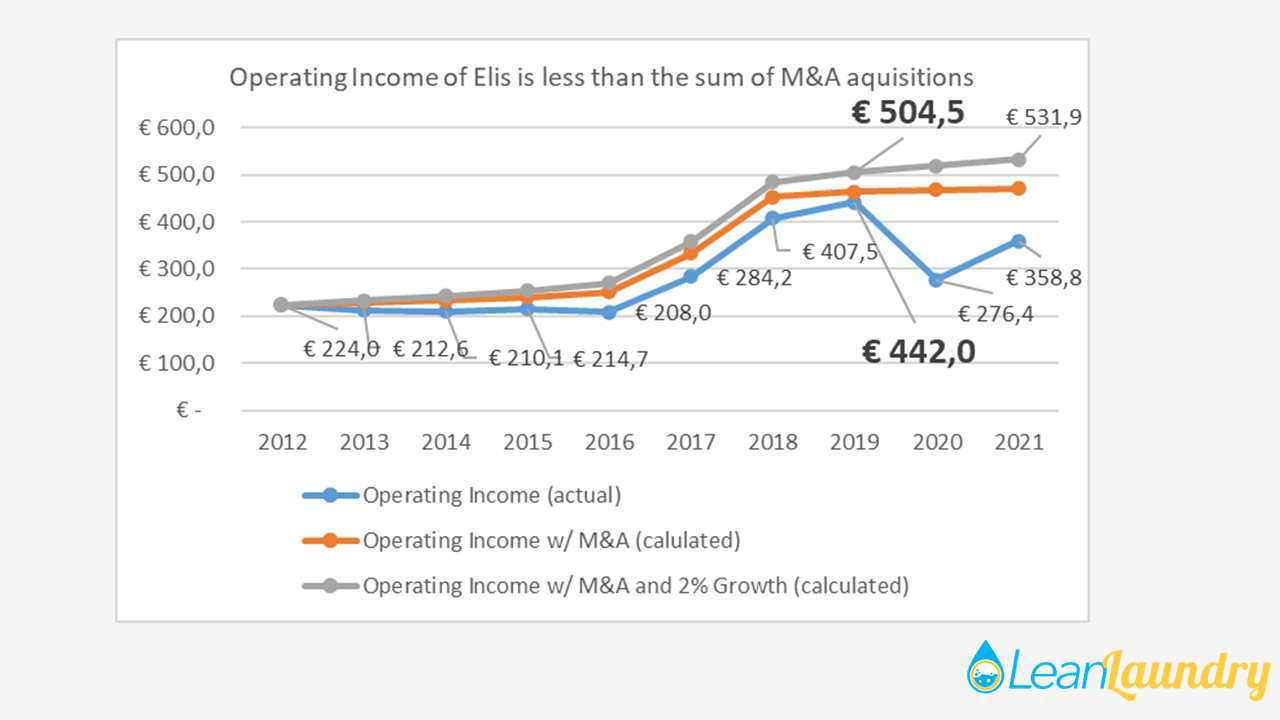

The result of the following calculation was very surprising for me.

Normally, the operating result from the M&A process should look like this: 1+1=2.5

In this calculation, the buyer would have generated 0.5 added value.

However, the reality is:

- Operating Income 2012: € 224 million.

- + Operating Income of all acquisitions of the last 10 years until 2019: € 239 million.

- = € 463 million

- The actual Operating Income in 2019 (before the pandemic) is € 442 million.

Thus, the operating result of Elis SA is lower than the operating result of all purchased companies.

Therefore, the formula of Elis is 1+1=1.95

Elis SA Service Group Comparison Operating Margin w/ Impact of M&A

If we assume an increase of only 2% in operating profit, the difference increases to around €60 million, and the operating profit in 2022 would have to be more than €550 million.

Not a good deal.

Challenges for M&A in the Textile Service Industry

M&A in Textile Rental has particular challenges:

Item List Harmonization

Almost certainly, the item list (SKU's) of the purchased company is not the same item list of the buyer (e.g., Elis).

This challenge leaves you with almost exclusively bad options:

- Scrap Old Texiles and Refit Customers.

Replacing all linen is massive capital destruction and would cost 40-80% of the purchased sales. Therefore, this is only an option for C-items. - Mixed Delivery of Old SKU's and New SKU's

This item changeover "on the fly" is possible only for a few items without compromising the service to the customer. It is the cheapest method but also the most significant risk of losing customers. - Use up the Textiles at Some Customers

Continue to use old items on some customers and restock new customers and some existing customers. This method sounds quite simple, but in practice, it is complex. For the production, the number of SKU's doubles, the current customers with the old items receive a constantly decreasing quality, and the field and office staff must administer this process over 3-5 years.

You end up discarding quite some linen anyway. - Continue the Item List of the Acquired Company

Continuing with the current item list is very easy for large corporate buyouts (e.g., Berendsen) since harmonizing the SKU's does not bring such large additional economies of scale.

In the case of small and medium-sized acquisitions, it is practically impossible to pay 10-30% more for these items in purchasing.

Complex Post-Merger Integration

The integration of a purchased company is complex almost, regardless of its size. The software, master data, etc., must be coordinated. The service portfolio, contract design, etc. must be harmonized.

If you do not proceed carefully, you will have burned out many customers and key employees.

Good Companies are Rare ... and the Price is Very High!

Unlike the hotel industry, there are far fewer good laundries to buy. These good companies have a very high market share locally, excellent profit margins, and are very expensive.

The danger, therefore, is that all the added value from the transaction goes to the buyer by paying too high a purchase price. While this is laudable, in this case, it does not add value to the shareholders of Elis SA.

Different Corporate Cultures

Small and medium-sized laundry companies define themselves as being the opposite of a corporation. They respond very individually to customer requests, are often available 24 hours a day on the cell phone for customers and employees, etc.

A corporation has to professionalize these structures and processes and thus risk losing many customers and employees.

Often, new management is then also necessary because the owners leave and with them many family members and friends. Finding good management in a laundry is a unique challenge!

Deferred Investments, Unknown Risks

When an entrepreneur sells, this has often been decided several years earlier. As a result, there is often insufficient investment in machinery, and an investment backlog arises that can quickly amount to 10-20% of sales.

Furthermore, it is difficult to judge as an outsider how high the actual risks are in the market. During the due diligence, you only see the expiration dates of various contracts, but the real story behind the market position is only known by the seller.

Is it Meaningful for Elis Service Group to Buy Small Laundries????

The above challenges are why it is not understandable that Elis buys many small businesses. In the case of Elis, I would define "small" as under €70 million in sales.

In small transactions, the transaction costs are very high relative to sales, and the risk of losing customers and employees is much greater. It is paradoxical, but a transaction with € 20 million in revenue can be as expensive in total Euros as one for a company with € 500 million.

Does Pest Control Make Sense for Elis SA?

The exception to the rule is probably only pest control. Here it makes sense to buy small companies and integrate them.

But whether this market makes sense for Elis SA is another question:

- Rent-o-kil has an estimated € 400 million in sales in Europe, and it is my opinion that Elis SA has no chance to become even remotely competitive here. (To date, Elis has bought € 25 million in sales with a purchase price of 1-5x sales).

- The synergy effects with textile rental lie only in the selling, but this is a theory because a specialist has much more authority than a textile service company. (Compare the homepages of Elis and Rent-o-kil).

- There was a reason why Rent-o-kil had divested itself of rental workwear ...

- Until 2019, Elis SA had focused only on France for pest control.

Since then, 1 (!) small company in Italy, 1 (!) small in Denmark, 1 (!) small in Spain, 1 (!) small in Ireland, and 1 (!) small in the Netherlands were bought.

Tour density is vital in this business. This spread of acquisitions will not achieve this.

Advantages of Organic Growth

Winning new customers with your own sales process has many advantages:

- The new customers matche the service and item base that one wants to offer.

- Prove of competitiveness.

- New customers are often more cost-efficient, as often the variable costs are well under 50% of sales.

- New plants are optimized for the current processes, and there are no legacy costs here.

The disadvantage of organic growth is that it is generally slower and that too fast organic growth is usually at the expense of price levels and profit margins.

Overall, however, organic growth is always healthier. (as long as pricing is healthy)

Critical Analysis of the M&A of Elis Services in South America

Brazil

Elis entered the market in a big way in 2014. Atmosfery's sales at that time were € 90 m. However, at the current exchange rate, sales are now only € 52 m, and the purchase price of around € 100 m was financed in euros. Thus, the initially "normal" price has become a costly purchase.

The same happened with Lembras and the 13 other smaller transactions.

Organic growth looks pretty high at first sight. If you contrast it with the inflation rate, the actual growth rate is about 3% above the inflation rate. I.e., OK, but not exceptional.

The increase in EBITDA from 24% to 35% is very remarkable. It would be essential to have background information here as to whether there was a switch from COG (customer owned goods) to textile rental to the same extent. Unfortunately, there is no information in the report on the development of the actual free cash flow or profit of Latin America.

Overall, Brazil seems to be operationally successful. Due to the devaluation of the currency, the purchase price was probably excessive at effectively 2.3 times sales.

Mexico

Elis Group is in the process of closing a transaction in Mexico.

The following key data:

- Sales € 74 million (-7% pandemic effect); currently 86% Healthcare

- EBITDA 38%

- EBIT (Operating Income) 18%

- Organic growth of 10% with an inflation rate between 1-8%.

- Market leader in Mexico, the only supplier with national reach, 100-year old family business, 320 tons per day, 11 plants with modern equipment, 2,600 employees, modern service with sterile surgical textiles and RFID, with European plant technology (Kannegiesser)

- With these specs, there is only one hit on Google: LAVARTEX

- Mexico is altogether an exciting market

So far, so good and also reasonable.

The purchase price is relatively high with 2.1 times sales or 2 times without pandemic, 5.6 times EBITDA, 12 times EBIT, and an additional earn-out for the following years.

At the last conference with the investors, the CEO of Elis said that Elis was the only bidder ...

Interesting fact: The closing is not until the end of July 2022 (?!). Why the transaction was published in March 2022 is interesting. One has the feeling that Elis has the stress to report something positive.

Thus, according to my assessment, there are the following risks:

- The Mexican Peso has halved in the last 20 years, and the inflation rate is currently at 10%. If Elis finances with Euro again, there is a risk that the high purchase price will be (significantly) higher. Financing in Mexico can be ruled out, as the yield on government bonds is 8.9%.

- Increasing the result from 18% EBIT is unrealistic. I.e., there is mainly a risk that the result will fall.

- Mexico is 128 of 180 countries in the corruption index (right next to Pakistan and even worse than Niger). This is a general comment on the state of Mexico.

- Big textile rental corporations like Elis have often had customer relationship challenges with large hospital customers, but this is Lavartex's primary revenue.

- The company has only been formed in the last five years through a merger of 3 companies. Maybe the existing owners have a reason they want to sell - as an outsider, you never know everything.

Is Elis SA Making the Same Mistakes as Berendsen in Europe or National Linen in America?

Laundry technology is very investment-intensive. Groups like Elis SA tend to keep the investment budgets for existing operations very tight. Postponing investments work well for 10-20 years. However, the backlog of investments causes lower productivity and, therefore, lower margins in the medium and long term.

Both Berendsen and National Linen were takeover candidates after a while.

Elis SA risks the same fate if the money is primarily used for the M&A process and not for the renewal of existing operations.

Final Assessment of the Elis SA M&A

- The major acquisitions (Berendsen, Indusal in Spain, Atmosfery and Lavebras in Brazil, now Lavartex in Mexico) make strategic sense.

The strategic significance of the remaining 134 transactions is only partially comprehensible to an outsider, and organic growth would probably be the better alternative. - Since Elis Group currently generates hardly any added value with the acquisitions, debt is increasing, and the M&A process may reach its limits in the next few years.

- Elis SA has no focus within the laundry industry, which poses a challenge to the complexity and profitability of the group.

- The company acquisitions in South and Central America appear overpriced in terms of the exchange rate and purchase price.

- Should the market for company acquisitions in the laundry industry become a buyer's market, this will mean new opportunities for Elis.

- With a 25% market share, Elis has a good starting point for the future. The management understands the laundry business and is very professional. If they focus on customer value, organic growth, and optimization of existing operations, they can be very successful.

- You can't underestimate Elis. They are very entrepreneurial and dare to take on big projects.

... last but not least: if someone wants to sell his company, he should do it soon 😉